Avoid Depreciation Recapture

IRS tax code allows investors to depreciate the improvements (buildings, etc.) related to real estate. However, if you sell your real estate investment and the property has increased in value, the IRS wants their money back and will assess you at a 25% tax rate on the amount you have previously deducted. For many investors who hold their real estate for an extended period, the depreciation recapture tax can be much higher than the capital gains tax (15%–20%).

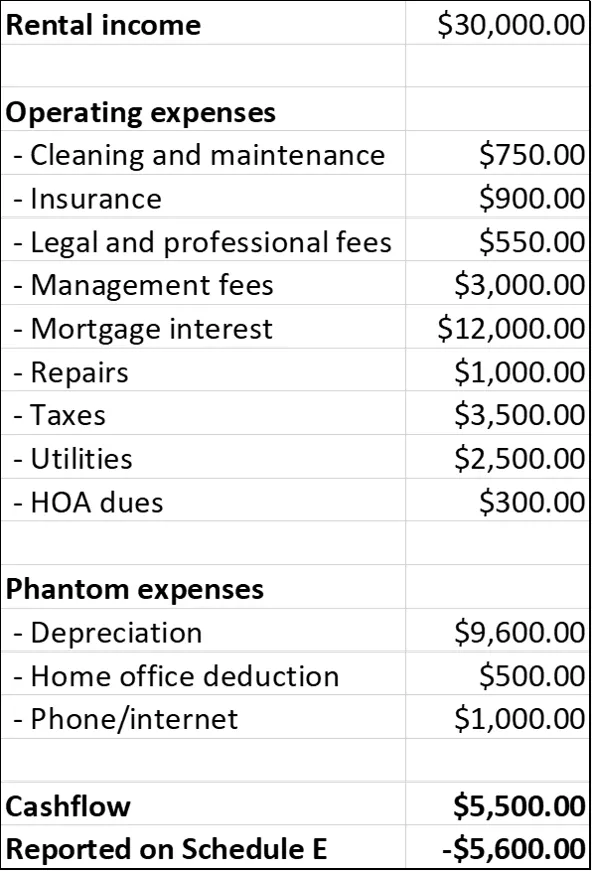

Positive Cash Flow and Tax Loss

One advantage of investing in rentals for cashflow over other forms of investing is that you often don’t pay taxes on the profit.

It’s often the case that you’ll show a loss on your tax returns while generating positive cashflow from your properties. In other words, you put money in your pocket from your rental and the government gives you back even more money at tax time.

Taxes are based on net income, which is what you have left over when you subtract all of the expenses from your rental income. Some of these expenses you don’t actually pay for but the IRS let’s you claim them on your taxes. These are sometimes referred to as “phantom expenses.”

Depreciation is one example of a phantom expense. It’s the reduction in value of your property from wear and tear that the IRS lets you deduct. It’s not a true expense. Another is the home office deduction. Same with phone/internet. You already buy these services for personal use but you have your rental business cover part of the bill.

Deductions of Rental Income

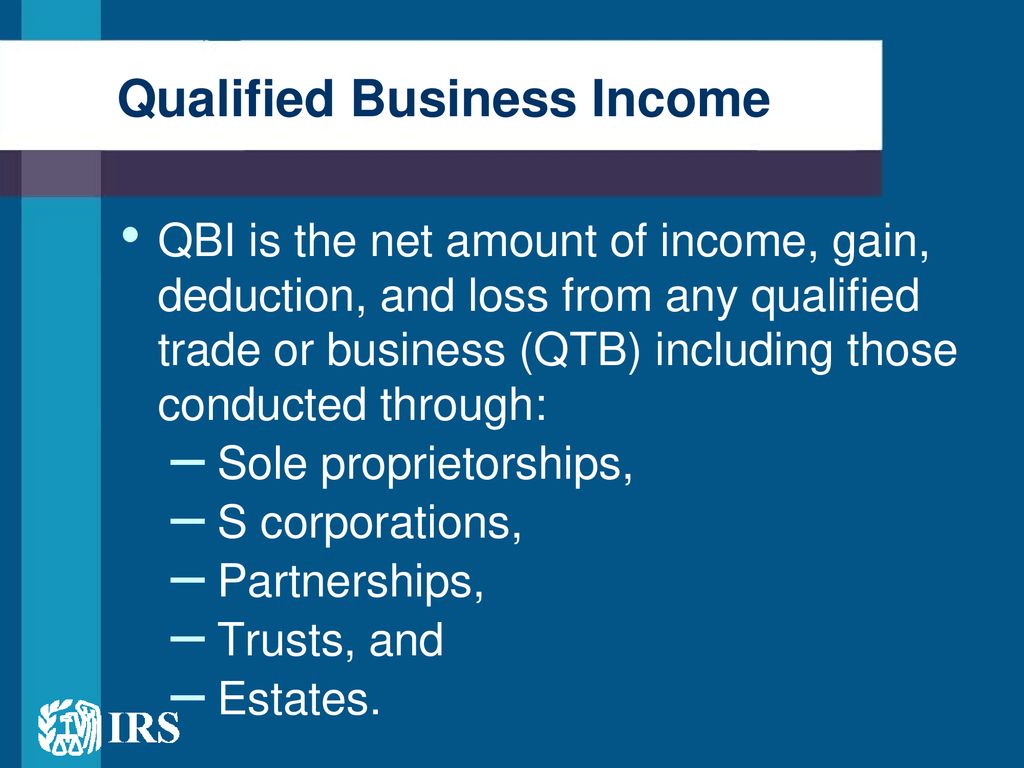

A pass-through deduction allows you to deduct up to 20% of your qualified business income (QBI) on your personal taxes. When you own rental property as a sole proprietor, via a partnership, or through an LLC or S Corp (known as pass-through entities), the money you collect in rent is considered QBI.

By using a pass-through deduction, you can write off up to $6,000 on your personal return. Some rules and regulations must be followed, so please consult with your accountant.

Rental Income is Taxed Differently

When you’re self-employed, you generally need to pay both the employer and employee portion of the FICA tax (covering Social Security and Medicare). However, if you own rental property, the money you receive isn’t classified as earned income. That means you’re eligible for one of the least talked about real estate tax breaks: Avoiding the FICA tax, also known as the payroll tax.

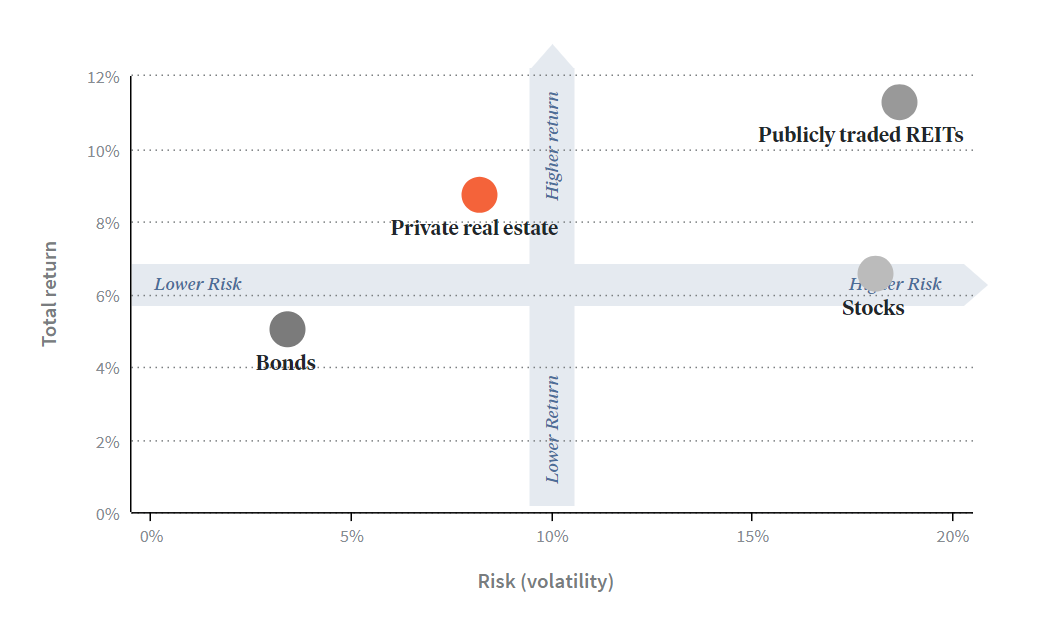

Investment diversification

If you hold investments in a 401k/IRA for retirement, holding a rental property can be a good diversification of assets.

Relative to a traditional portfolio composed of 60% large-cap stocks and 40% bonds, a portfolio which includes some allocation to private real estate has historically shown the ability to drive higher returns, with generally more annual income and lower volatility over the past 20 years.

Please Consult a Tax Professional About Any and All Benefits of Owning a Rental Property.

On Q Makes No Claim to The Information Listed Above

Get a Free Management Quote & Rent Appraisal

Rental Property Management

Tax Information Resources

There are several places online you can find great information

on the tax ins and outs of rental properties

Our Company

On Q Property Management is a full-service Property Management company specializing in managing residential rental properties. On Q's client-first approach - utilizing a proprietary process and set of tools - delivers a more transparent and profitable property management experience. With year-long tenant guarantees and a no-fee cancelation policy, On Q is dedicated to earning you business month after month.

Arizona Designated Broker: Eric Dixon

Texas Designated Broker: Rodney Henson

Texas Real Estate Commission Information About Brokerage Services

Texas Real Estate Commission Consumer Protection Notice